Content

- The Difference Between A Trial Balance And A General Ledger

- Chapter 2: The Accounting Cycle

- Free Accounting Courses

- Trial Balance Results

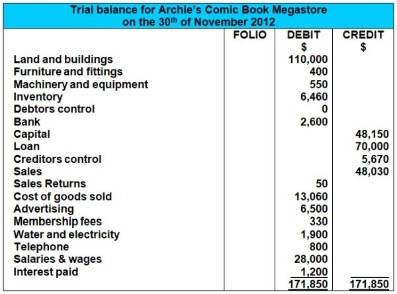

Although you can prepare a trial balance at any time, you would typically prepare a trial balance before preparing the financial statements. A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance. The debit balance values will be listed in the debit column of the trial balance and the credit value balance will be listed in the credit column.The Integrated Word-Excel-PowerPoint system guides you surely and quickly to professional quality results with a competitive edge. Rely on BC Templates 2021 and win approvals, funding, and top-level support. Third, finding and fixing accounting errors during the Trial Balance Period. Click a ledger balance amount within the grid to access the Ledger Balance for Selected Account page, where you can view the ledger balance details by dimension.

What’s included in a trial balance?

A trial balance includes a list of all general ledger account totals. Each account should include an account number, description of the account, and its final debit/credit balance.The debit should have been to the utilities expense account, but the trial balance will still show that the total amount of debits equals the total number of credits. F the “debit DR” and “credit CR” balance totals do not match in the trial balance exercise, there is an accounting error somewhere in the account balances. The firm will try to find the mistakes responsible for the mismatch, and correct them, before publishing financial statements. During the trial balance period, accountants will also search for and try to fix other kinds of accounting errors that the trial balance does not reveal. Trial balance reports are useful when you need to verify the accuracy of individual ledger account balances and your overall ledger.

The Difference Between A Trial Balance And A General Ledger

The total amount of debits and credits in each accounting entry should match. A successful trial balance notwithstanding, accountants will still check carefully for the other kinds of accounting errors that do not impact a trial balance. Once they correct all mistakes, the account balances are ready for publication in the period financial accounting reports . An error of omission is when a transaction is completely omitted from the accounting records.For example, many organisations use trial balance accounting at the end of each reporting period. A trial balance only checks the sum of debits against the sum of credits. The following are the main classes of errors that are not detected by the trial balance. Finally, if some adjusting entries were entered, it must be reflected on a trial balance. In this case, it should show the figures before the adjustment, the adjusting entry, and the balances after the adjustment. This extract shows transactions and balances for one week in September. Like other asset accounts, Cash on hand is said to carry a debit balance.

- If this step does not locate the error, divide the difference in the totals by 2 and then by 9.

- The trial balance is a part of the double-entry bookkeeping system and uses the classic ‘T’ account format for presenting values.

- By checking this, if an accountant finds that the trial balance does not agree, any differences can be investigated and straightened out prior to crafting the financial statements.

- If the error is not apparent, return to the ledger and recalculate each account’s balance.

- Whereas the liabilities, revenue, and equity accounts should have a credit balance.

All involved want to avoid a lesser opinion, “Qualified,” or even worse, “Adverse.” The trial balance can still overlook other kinds of accounting errors. It will not detect, for instance, transactions that should have been posted but were not. If you specify a book code group, the trial balance grid lists the primary book code balances and secondary book code balances. The column headings are defined by the primary description and secondary description fields on the book code group definition.

Chapter 2: The Accounting Cycle

He is the sole author of all the materials on AccountingCoach.com.

The firm makes an entry as a debit to an account when it should have a credit, and its corresponding co-transaction registers as a credit when it should be a debit. When the difference between debit and credit totals is divisible neither by 9 or by 2, it is possible that a single “debit” or “credit” balance is missing from the account lists.

Free Accounting Courses

Select which information appears when you view balance amount details. FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy. Learn more about how you can improve payment processing at your business today. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years.When the trial balance balances, as in the previous section, the Balance sheet will also balance. Exhibit 3 also shows the impact of debit and credit transactions in each of account type. He trial balance highlights a well-known advantage of the double-entry system—built-in error checking.

Trial Balance Results

Suppose a company has a cash account with a balance of $1,750, accounts receivable of $250, accounts payable of $1,500, and stockholder equity of $500. By checking this, if an accountant finds that the trial balance does not agree, any differences can be investigated and straightened out prior to crafting the financial statements. Whereas the liabilities, revenue, and equity accounts should have a credit balance. You can prepare your trial balance at regular intervals to make sure your books are balanced.In all cases, they must include a written “opinion” by external auditors. And, in most cases, the only acceptable opinion is the highest possible rating, an Unqualified opinion.

What is a GL posting?

Posting to the general ledger involves recording detailed accounting transactions in the general ledger. It involves aggregating financial transactions from where they are stored in specialized ledgers and transferring the information into the general ledger.The trial balance test does not detect the following kinds of errors. Therefore, when the accountant finds a trial balance difference divisible by 2, the first step is to look for an account balance exactly half the difference. The trial balance test, of course, occurs in the table’s bottom row, where the two kinds of totals either match or do not match. Firstly, a debit entry in one account did not bring an equal and offsetting credit entry in another. You can view a trial balance for all accounts, or for a subset of accounts.

Example Account Balance: Cash On Hand

The trial balance period is the final phase before publishing financial reports. Additionally, a trial balance does serve to show that debit and credit balances are equal, and this helps to ensure that corresponding debit and credit entries are made for every transaction.Used in the double-entry bookkeeping system, a trial balance lists all debit and credit balance amounts for a period of time. It is often the first step towards interpreting your financial results. If the difference is divisible by 9, you may have made a transposition error in transferring a balance to the trial balance or a slide error. A transposition error occurs when two digits are reversed in an amount (e.g. writing 753 as 573 or 110 as 101). A slide error occurs when you place a decimal point incorrectly (e.g. $ 1,500 recorded as $ 15.00). Thus, when a difference is divisible by 9, compare the trial balance amounts with the general ledger account balances to see if you made a transposition or slide error in transferring the amounts.Or the most part, line items on the period’s Balance sheet and Income statement are nothing more than account names. And, figures reported for each item are merely the account balances. Exhibit 2, below, helps explain the meaning of account balance in this context. Consider, for instance, just one account, “Cash on hand.” Debit and credit transactions in this account have transferred from the journal to the general ledger.

The general ledger is used to record all of your company’s transactions. To get started with recording the trial balance, you must first complete these ledger accounts. You can sum up the transactions using a trial balance format, making separate columns for debits and credits. The left column should show all debit balances, and the right column will show all credit balances.In fact, when accountants are confident that the account balances are error-free, they build the new Balance sheet and Income statement directly from the list of accounts and their balances. Use this report to print a statutory account on a trial balance instead of the business unit.object.subsidiary account code. The category code indicates the account number and the category code description indicates the account description. To review balances for business units, print the Trial Balance by Business Unit report. You can specify summarization at any level of detail without printing lower levels. This report provides subtotals at all higher levels and a grand total for company and report. The following trial balance example combines the debit and credit totals into the second column, so that the summary balance for the total is zero.Specify whether to combine debit and credit balances in a single column, or view them in separate columns. This additional level of detail reveals the activity in an account during an accounting period, which makes it easier to conduct research and spot possible errors. The total of the debits and the credits on the trial balance should be equal. This will show that there are no mathematical errors, but other errors may exist in your accounting system. It’s important to note, however, that although performing trial balance accounting can highlight simple mathematical errors, it won’t reveal every problem in your books.This error must be found before a profit and loss statement and balance sheet can be produced. Whenever any adjustment is performed run trial balance and confirm if all the debit amount is equal to credit amount. Note that the trial balance period also includes reconciliation, the process of checking account balances against other sources. Bank statements should agree with ledger balances for cash accounts, for instance. And, liability accounts for bank loans should coincide with the lender’s account statements, and so on.The terms have meaning only in companies that use a double-entry accounting system. In effect, there is no longer a need to use the trial balance report in accounting operations. A trial balance ensures that for every debit entry, there is a corresponding credit entry recorded in the books, which is the basis of double-entry accounting. The trial balance lists the closing balances of the accounts from the general ledger as of a specific date. An error of commission is when the entries are made at the correct amount, and the appropriate side , but one or more entries are made to the wrong account of the correct type.